UK Retail & Clinical Wellness Market Summary

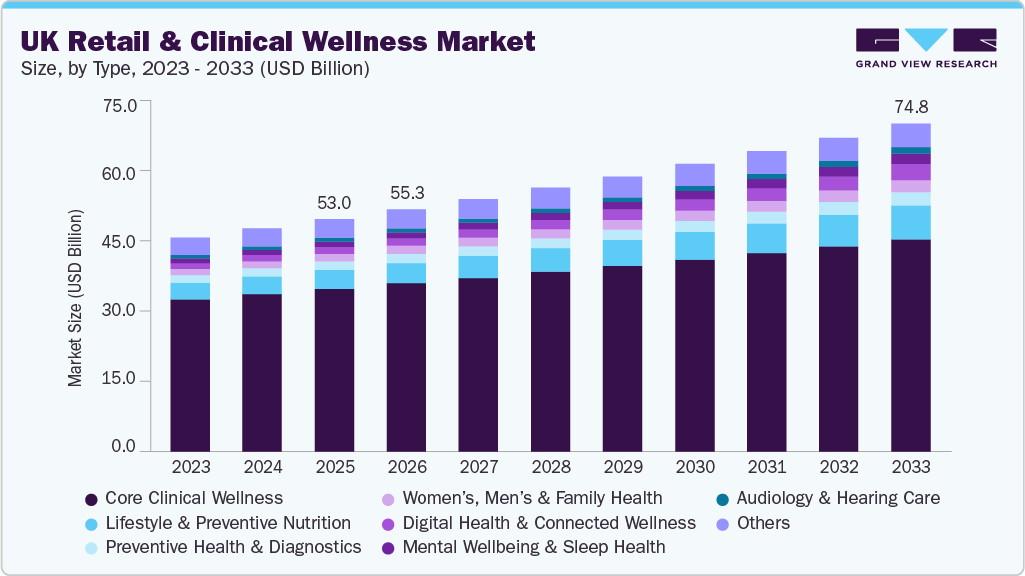

In the heart of London, amidst the bustling commuters and the rhythmic honks of black cabs, a quiet revolution is unfolding. Shoppers are increasingly steering away from traditional retail therapy, replacing it with a new emphasis on wellness. This cultural shift is manifesting itself in the staggering growth of the UK retail and clinical wellness market, projected to grow from USD 53.01 billion in 2025 to USD 74.79 billion by 2033, reflecting a compound annual growth rate (CAGR) of 4.42% from 2026 to 2033. According to experts, this growth is fueled not by mere consumerism, but by a profound societal focus on prevention and self-care.

Market Drivers: The Rise of Preventive Health

The growing appeal of preventive health options has ignited a wave of demand for products ranging from dietary supplements to digital health tools. A recent survey revealed that 61% of UK adults now consume dietary supplements daily, shifting the narrative around health from reactive to proactive. As Dr. Elaine Harris, a leading health economist, notes, “This shift indicates a culturally embedded desire for better health outcomes and a reliance on self-directed wellness routines.”

- Consumer Focus on Prevention: Over half of health purchases are now motivated by concerns over long-term health rather than immediate needs.

- Digital Adoption: Increasing smartphone penetration has popularized health-tracking apps, with approximately 79% of users preferring providers with digital solutions.

- Economic Factors: The rise of privately funded health services and affordable supplement options has made health more accessible than ever.

Case Study: Supplements Evolve into Essentials

UK consumers’ attitudes towards dietary supplements are undergoing a renaissance. Once viewed as niche products, these items have become a staple in many households. Data indicates that Vitamin D leads the pack, with a staggering 54% of the population integrating it into their daily routines. Research conducted by W-Wellness highlights that almost half of the supplement users take them to improve overall health—a clear indication of the preventive health mindset taking root.

However, this independent approach carries risks. According to the survey, 24% of participants report feeling overwhelmed by online information about these products. Dr. Sarah Williams, a public health researcher, emphasizes the challenge: “With the availability of vast information, consumers find themselves at risk of misinformation, making trusted guidance imperative.”

Market Opportunities: Filling the Gaps

The landscape of the wellness market is opening doors for clear guidance and support. Increasingly, consumers are searching for:

- Transparent ingredient listings

- Quality sourcing assurances

- Customized wellness solutions

As demand for these attributes grows, businesses have the chance to fill existing gaps, offering credible, evidence-backed products that cater to well-informed consumers.

Digital Transformation in Wellness

As healthcare shifts toward digital solutions, the integration of technology into the wellness sector becomes imperative. The expansion of mobile health applications and tele-health services has provided a platform for preventive health management. With over 318,000 healthcare apps currently available, many UK consumers are embracing these tools to track their health data, changing how wellness is perceived.

A report by CloudXperte outlines that the pandemic has accelerated this adoption, with 50% of consumers willing to switch providers for better technology. The NHS, too, is evolving; the launch of the “Pharmacy First” service enables individuals to consult pharmacists for common ailments without overwhelming GP facilities.

Health Spending Trends: Insights from Early 2025

| Category | Trend / Growth | Key Demographics | Insights / Implications |

| Gym & Fitness Spending | +11% over Christmas, +4% in January | 18-34 (+8% YoY) | Younger consumers prioritize health over nightlife, highlighting a commitment to fitness. |

| Specialist Grocery Products | +6% | Older generations, 65+ (+9%) | Health-conscious food choices are rising among older consumers, who are increasingly shopping online. |

Market Concentration & Characteristics

With the market rapidly evolving, the UK wellness sector remains highly fragmented yet innovative. Notably, key players like Boots UK and Tesco Health are integrating preventive health services into their offerings. “We are witnessing a convergence of retail and clinical wellness, making health services accessible at every corner,” comments industry analyst Mark Thompson.

The collaboration between companies often leads to opportunities for service expansion. For example, in March 2025, Walgreens Boots Alliance, the parent company of Boots UK, entered into an agreement that aims to bolster its health service capabilities, showcasing how traditional retailers are adapting to meet modern consumer demands.

Recent Developments in Clinical Services

- In April 2025, Pharmacy2U partnered with ORCHA to enhance access to clinically assured health applications.

- In March 2025, Tesco unveiled two new health clinics, enabling customers to engage in large-scale health research focused on disease prevention.

- Numan launched a digital health coaching platform in January 2025, integrating AI to provide personalized health guidance.

As the UK retail and clinical wellness market continues to grow, it’s clear that consumers are not merely waiting for better health; they are actively seeking it. With significant shifts toward digital engagement, personalized solutions, and a deeper understanding of preventive health, both retail and clinical providers must navigate this landscape adeptly to remain relevant. In the end, wellness is becoming increasingly intertwined with everyday life, and as the old adage goes, “An ounce of prevention is worth a pound of cure.” The UK is setting a prime example for this new age of health-conscious consumers.

Source: www.grandviewresearch.com